INVESTMENT TREATIES AND INVESTOR-STATE DISPUTE SETTLEMENT

The world needs to be more outraged about investment treaties and investor-state dispute settlement (ISDS). But most people don’t know anything about this secretive system and its impacts on sustainable development, climate action, and human rights. In this series we teamed up with experts at the Columbia Center on Sustainable Investment to unpack the treaties and ISDS.

If these illustrations pique your interest, you can get a bigger hit of information in increasing doses from:

Anna’s ILA Reporter blog article (forthcoming).

This CCSI primer on international investment treaties and ISDS.

This CCSI paper on how the treaties can align with sustainable development.

Creative Commons! Spread the word about ISDS by sharing our illustrations: Investor-State Dispute Settlement Series © 2021 by Picture Human Rights and the Columbia Center on Sustainable Investment is licensed under CC BY-NC-ND 4.0.

You can download the illustrations individually below or in one folder here.

What is foreign direct investment (FDI)?

FDI occurs when an individual or corporation in one country (“home state”) sets up or buys a controlling interest in a company that is incorporated in a different country (“host state”). Companies invest abroad for various reasons, including to access land-based resources including mining or for more affordable labour, for instance in manufacturing. They might also invest abroad in order to acquire competitors and their assets.

What are international investment Treaties (IITs)?

International investment treaties are bilateral or multilateral treaties that commit state-parties to afford specific standards of treatment to foreign investors from the other state-parties. States often sign IITs based on the assumptions that investment protections and privileges will promote investment flows and therefore sustainable economic development. Empirical evidence, however, does not show that IITs actually stimulate new investments, let alone whether those investments in fact benefit host (or home) countries.

drivers of FDI

Companies invest abroad for various reasons, including to access land-based resources including mining or for more affordable labour, for instance in manufacturing. They might also invest abroad in order to acquire competitors and their assets.

ISDS: THE POWER

International Investment Treaties typically require states to provide foreign investors certain standards of treatment, which the investors can enforce directly by suing the states for alleged breaches.

ISDS: THE PROCESS AND THE PEOPLE

ISDS lets investors skip domestic remedies and sue governments through arbitration, with the arbitrators chosen and paid for by the parties. This special forum is only available for investors to sue states, not vice versa, because international investment treaties almost universally place enforceable obligations only on states, not investors. An investor may win an ISDS case even if it has violated domestic or international law, including violating human rights or environmental obligations.

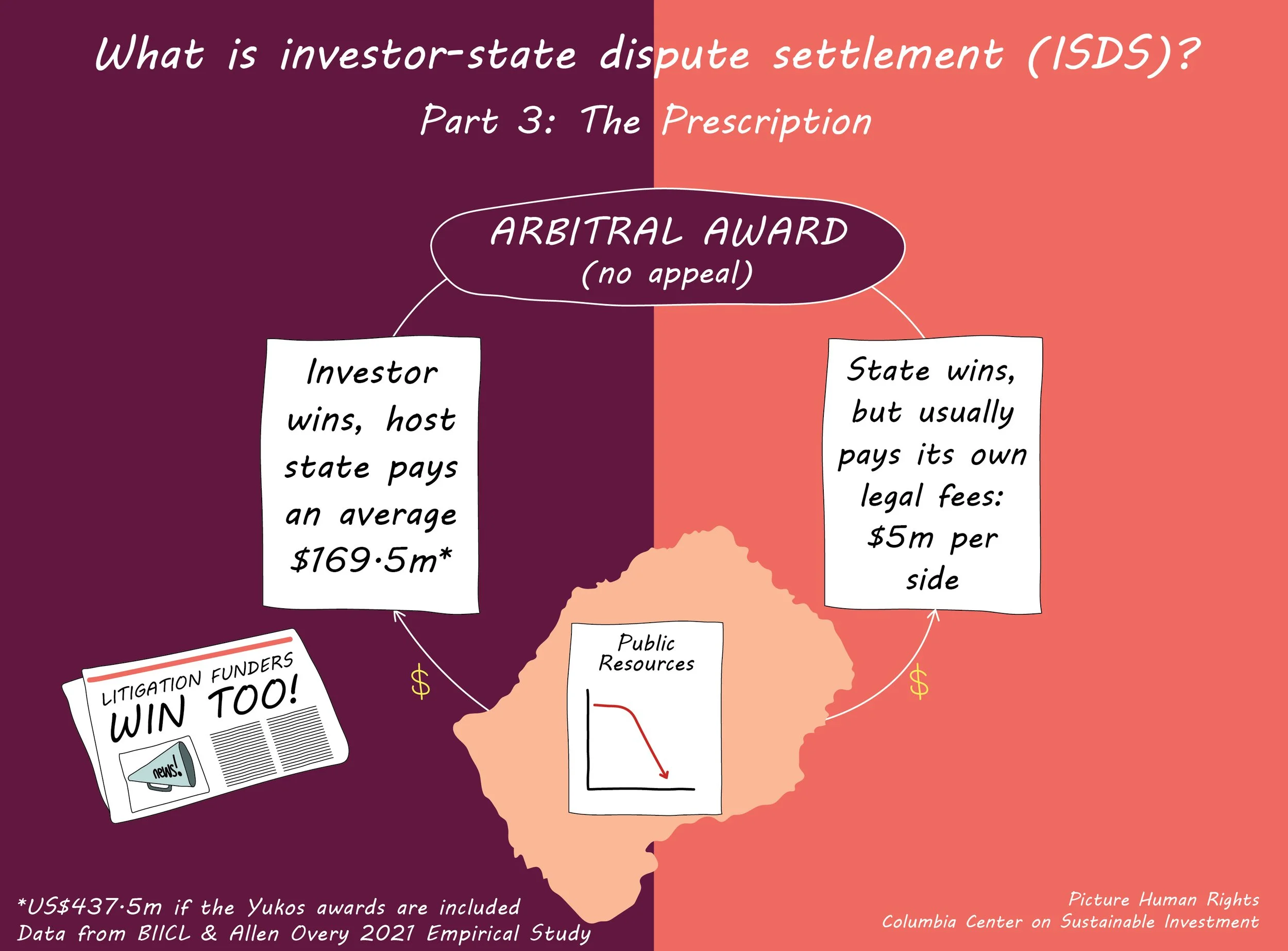

ISDS: The prescription

When an arbitration panel makes a decision, it issues an “arbitral award” from which there is no right of appeal. The tribunals can order remedies, usually in the form of monetary awards. International investment treaties with ISDS provisions tend to make life much more expensive for countries, whether because they have to pay an average sum of $US169.5m per lost case in damages (US$437.5m if the Yukos awards are included), or they have to bear an average of $5m in legal costs even if they win.

WHO CAN BE AFFECTED BY ISDS?

Third parties often have an interest in ISDS disputes because their rights and interests will be affected by the outcome. Even other branches of government, like local governments or environmental ministries, may have policies or enforcement thwarted by ISDS claims and awards. Nevertheless, third parties are not generally permitted to participate in ISDS proceedings. Tribunals can choose whether or not to accept third-party amicus briefs, but frequently reject them. ISDS arbitrations are generally opaque and exclusive; much more so than domestic legal systems which tend to have transparency and mechanisms to protect the rights and interests of non-parties.

CORPORATE STRUCTURING

While evidence is lacking that IITs stimulate new investment flows, they may affect how investments are structured, since many treaties allow investors to bring claims through subsidiaries and holding companies located in state-parties. Multinational enterprises also use such complex corporate structures limit liability, minimize tax payments, and hide beneficial ownership.

COSTS VERSUS BENEFITS OF EXISTING INVESTMENT TREATIES

Not only do IITs seem ineffective at stimulating at new investment, but there are known costs associated with investment treaties, for instance in lost regulatory space, costs of defending disputes, and costs of paying adverse awards.

A NEW ERA OF SDG-ALIGED INVESTMENT TREATIES

Countries can and should review their existing international investment treaties, and get rid of ISDS as a dispute mechanism. It is time for a new era of international investment treaties that are structured to support rather than impede sustainable development.